Midyear Planning & The Tax Cuts and Jobs Act

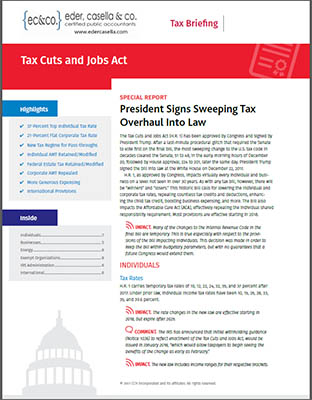

As we reach the midpoint of 2018, it is an ideal time to review your finances as they relate to our newest tax laws. Although we tend to look at this information at tax time and at the end of the year, it can be very beneficial to review and make changes now. This can help to mitigate some of the tax liability you may incur. As a reminder, we’ve included a downloadable comprehensive briefing of the Tax Cuts and Jobs Act with commentary to help you understand the impact of some of the key points.

Still have questions on what you should be doing? At Eder, Casella & Co., we strive to offer added value to everything we do for you. That includes providing advice and guidance on how to optimize profitability while keeping taxes at a minimum.

Call us today to discuss your options and make a midyear plan for your personal and business finances.

815-344-1300