Illinois Minimum Wage 2022 Increase

As another year nears its end and we look towards 2022, we wanted to take a moment to remind our clients of the next installment in the Illinois scheduled minimum wage increases. It is important to know what these changes look like whether you are a business owner or an individual receiving minimum wage.

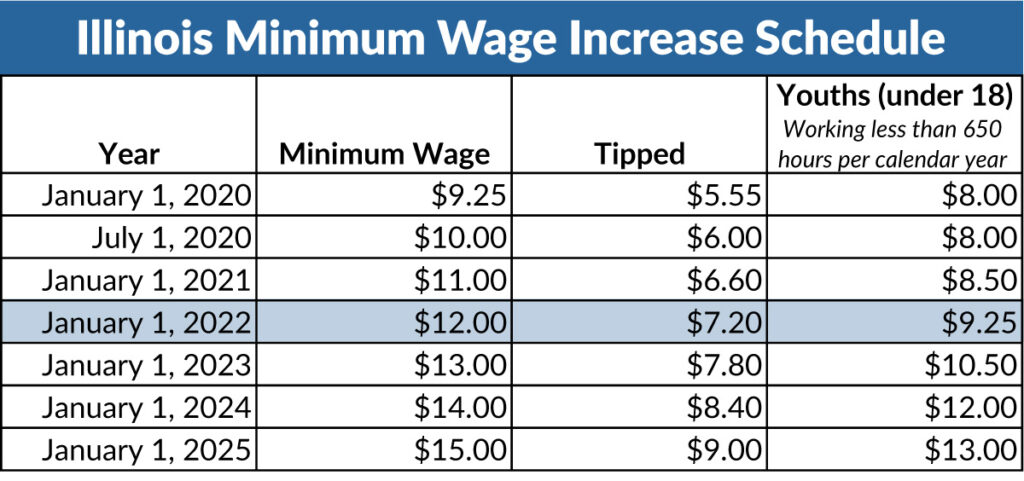

January 1, 2022, triggers the next scheduled increase with Illinois minimum wage rising from $11.00 to $12.00 per hour. The minimum wage will continue to increase by $1.00 per hour each January 1st until it reaches $15.00 per hour on January 1, 2025.

This scheduled increase also impacts the tipped employee wage rate, which is 60% of the hourly minimum wage. Effective January 1, 2022, the tipped wage rate will increase to $7.20 per hour and continue to increase annually based on minimum wage increases.

Below is a breakdown of Illinois’ scheduled minimum wage rate increases by year.

For further information on these increases, please visit the Illinois Department of Labor website.

Eder, Casella & Co is here to guide you through these increases to ensure that you stay compliant. Please reach out to our payroll specialists at payroll@eccezion.com should you have any questions.